Financial Kickstart Program

Starting off financially independent at a young age is no easy feat! But, with a little guidance and help along the way, anyone can pave the way for a future you are confident in, while building a personal connection with an advisor you can trust.

This financial independence kickstart program has been specifically curated for young professionals who may not even know where there may be gaps, how to start to plan, ways to maximize and more.

This meeting series is the first step you never knew you needed to have financial independence now and start your Two Comma Life today! This program will give you the foundations for life long financial independence, while giving you practical steps to start now!

Meet Kaitlyn Hedger!

Kaitlyn will embark on your journey with you working hand in hand and side by side. She is excited to get to know you personally and discover solutions and structured plans for your needs.

FAQs

1. Who is the Kickstart Program for?

The program is designed for young adults (late 20s early 30s) looking to get their financial footing off to a good start with the necessary education and action items to best hit their goals. Even if this meeting series isn’t perfect for you we would love to help with what you do need – please reach out to our office to schedule!

2. What is the cost of the program and when do I pay?

You have two options for payment. You can pay $100 a month for 12 months or $1,000 upfront. After you have your intro meeting we will work with you. If you are gifting the program to someone we ask you pay $1,000 at the start of their meeting series.

3. What’s included in the $100 monthly cost?

The fee covers a comprehensive financial planning experience, including multiple planning sessions, personalized reports, tools like Black Diamond, budgeting worksheets, and access to secure document storage and tracking. We also have an accompanying workbook to help you stay on track.

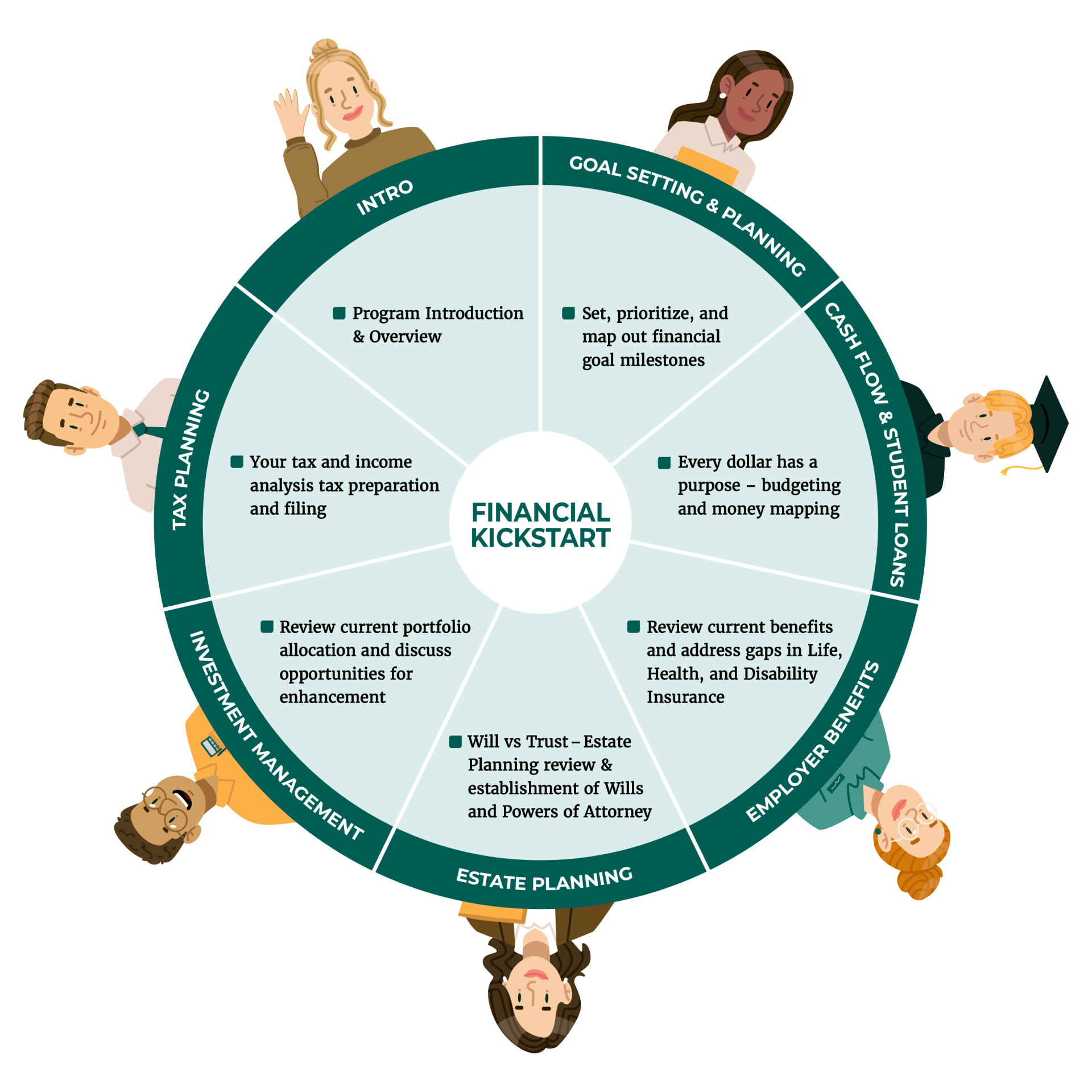

3. What topics are covered in the program? Can we discuss things not specifically outlined in the meeting series?

We address budgeting, student loans, debt management, employer benefits, estate planning, investments, and taxes—empowering you with knowledge and actionable strategies. A huge part of this program is getting to know you and your individualized needs so we tailor the program to you. We are happy to discuss the program more with you before you decide to jump in!

4. What’s the time commitment?

You’ll participate in roughly 8 meetings over the course of a year, each ranging from 30 minutes to 1 hour but you have control over when is best for you to meet. We recommend you spend some time in the workbook before and after meetings.

5. Where do we meet?

Kaitlyn works out of the Frankfort and St. Charles offices but is also happy to meet via Zoom for virtual meetings.

6. Do I need to have any financial knowledge to start?

Not at all! The program is beginner-friendly and designed to meet you where you are. We’ll walk you through each step and provide the tools you need.

7. What’s Black Diamond, and why is it used?

Black Diamond is a secure platform where you can link accounts, monitor your net worth, track your financial to-dos, and store key documents—giving you an organized financial home base.

8. Can this be gifted to someone else?

Yes! It’s a great gift for graduation, to celebrate a new role, or simply as a way to help someone get a head start financially.

9. Is this a one-time plan or ongoing support?

While the Kickstart Program is a standalone plan, it’s included under our ongoing financial planning agreement—so you can choose to continue working with us after the program ends. PrairieView Wealth & Tax Advisors is a comprehensive financial planning service and we look forward to working with you now as you begin your journey as well as 5, 20, 50 years down the road as you continue to live your two comma life.